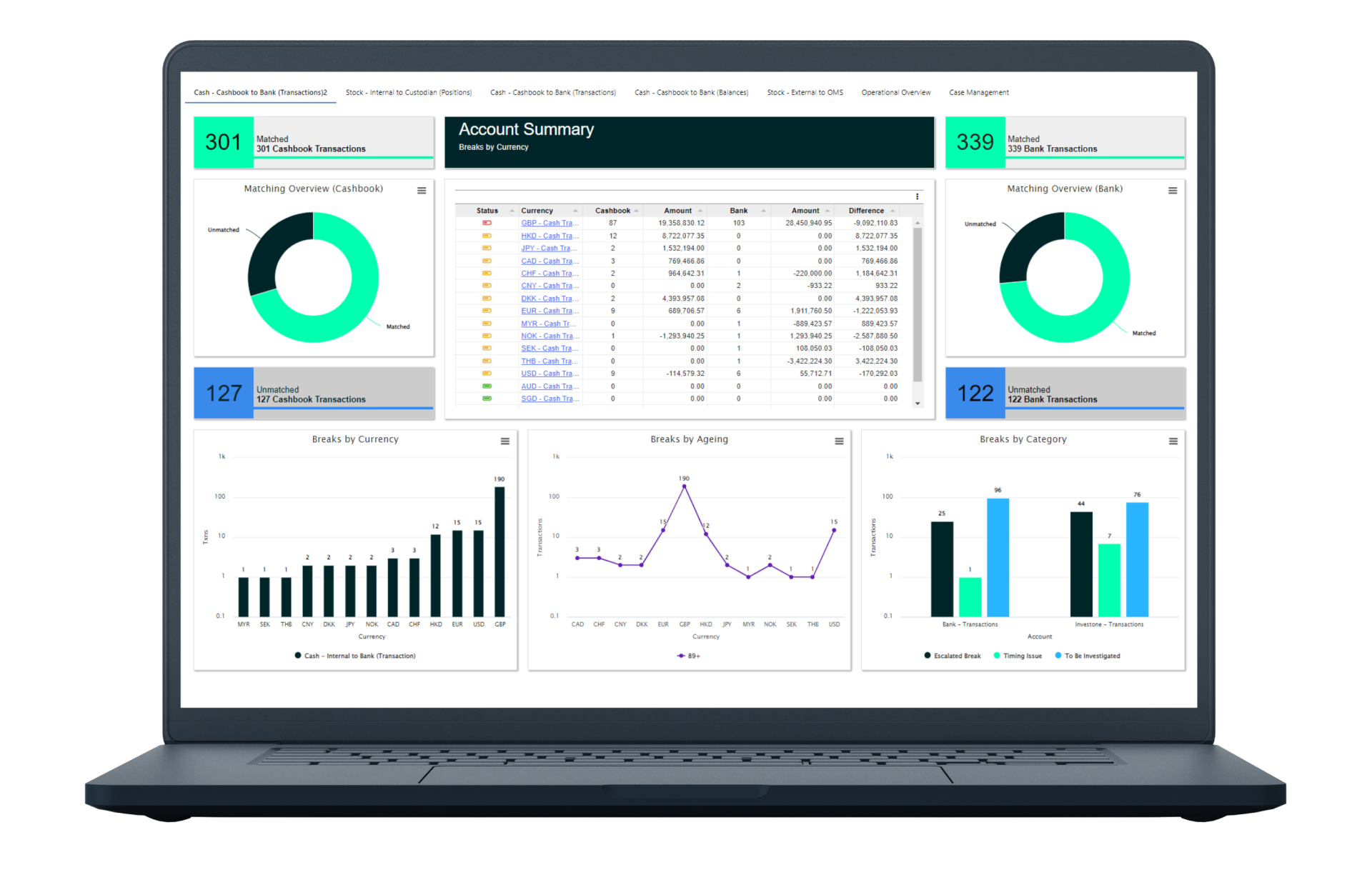

Revolutionise your finance operations and controls

Reduce costs, achieve compliance and take control of your data with automated reconciliation software trusted by the leading names in finance.

Reduce costs, achieve compliance and take control of your data with automated reconciliation software trusted by the leading names in finance.