Posted: 28/04/2025 | Read time: 3 minutes

The rise of private credit

Private credit is one of the fastest-growing segments in global financial markets. With interest rates expected to have peaked and macroeconomic resilience improving in both Europe and North America, forecasts estimate the private credit market could reach $3 trillion globally by 2028.

This surge is being driven by:

- Increased investor appetite for higher-yielding alternatives

- Expansion of mid-market lending

- Growth in origination technology

- New entrants leveraging broker partnerships

As volumes rise, so does the pressure on infrastructure, especially around how these instruments are processed and traded.

What is private credit and how does it work?

At its core, private credit refers to non-bank lending (typically in the form of secured or unsecured loans), issued by hedge funds, investment managers, insurance firms and other non-traditional lenders.

Key characteristics:

- Higher yields due to elevated credit risk

- Can be less liquid than non-specialist loan products

- Complexity in terms of structure, collateral, and servicing

To enhance liquidity and risk distribution, these loans can be packaged by investment banks into securities like Collateralised Debt Obligations (CDOs) or Collateralised Loan Obligations (CLOs). These structures allow investors to buy into diversified pools of private loans, In return receiving a regular cashflow with the benefit of improved liquidity.

The operational challenge: complexity at scale

As the market matures, the operational backbone underpinning private credit is under strain. The challenge is twofold: operational complexity and volume of transactions.

For private credit issuers

Firms issuing private credit must manage complex servicing flows:

- Aligning loan remittances with ledger entries

- Tracking collateral and covenants

- Integrating data from custodians, trustees, and agents

This requires robust back-office systems, yet many still rely on patchwork processes and manual data handling.

For traders

Trading CDOs and CLOs introduces another layer of operational friction:

- Trades typically happen over the counter, requiring rigorous pre-matching and validation to ensure settlement

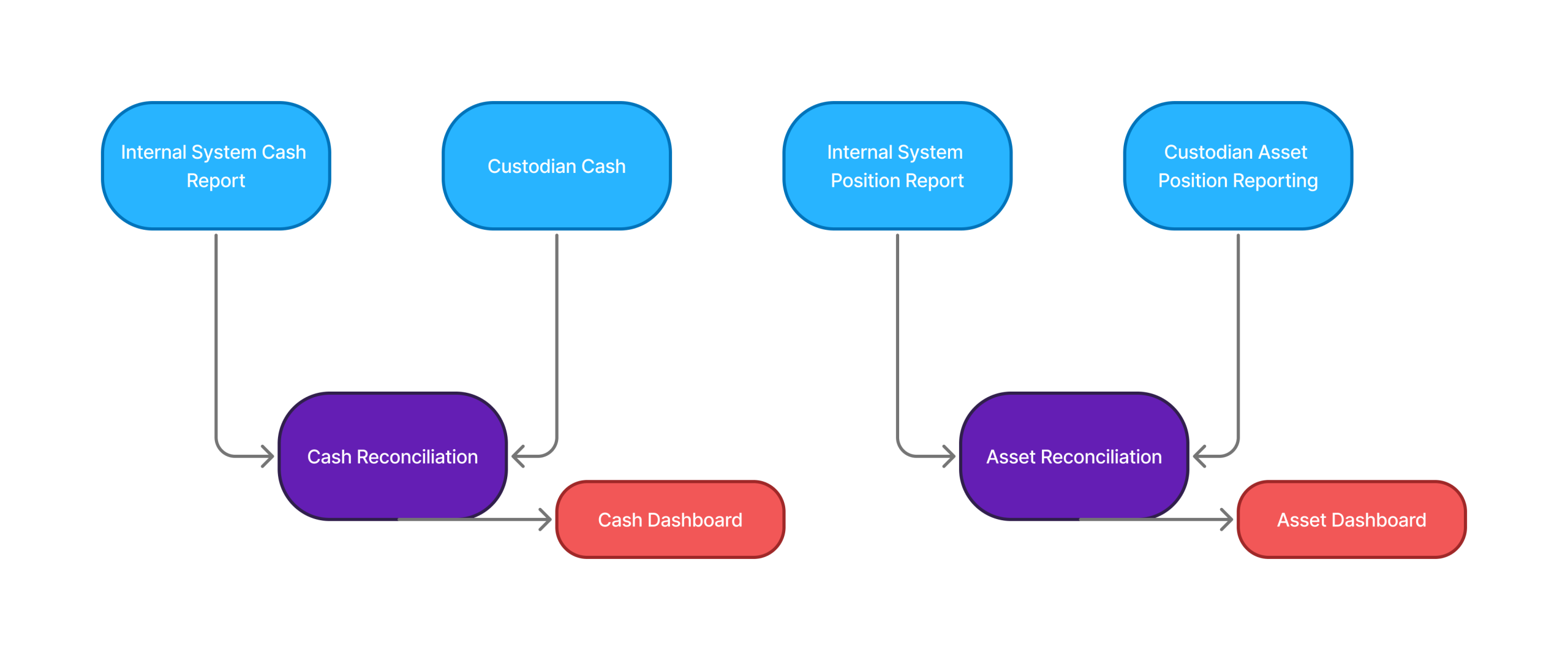

- Post-trade reconciliation requirements must happen at both security positional and cash flow levels

- Agent banks and custodians often introduce fragmented, non-standard data formats

All of this makes post-trade processing slow, error-prone and expensive.

For data management

One of the most acute challenges is data fragmentation:

- Trade data is not standardised, and can include SWIFT messages, non-structured data and proprietary data files

- Internal systems struggle to interpret disparate formats

- Teams resort to Excel macros and manual matching – decreasing operational efficiency and reducing control

This results in:

- Higher operational cost per trade

- Bottlenecks during volume spikes

- Diminished reporting quality and regulatory exposure

In a market with growing demand and shrinking margins, this is not sustainable.

How can AutoRek help?

AutoRek is an end-to-end financial controls platform that automates reconciliations, data management, and reporting.

How it fits the private credit space:

- Data agnostic: Ingests data in any format and from any source at any level of volume.

- Automated reconciliations: Eliminates manual matching and spreadsheet-heavy processes

- Low-code configuration: Lets users build workflows and reconciliation rules without developer input

- Scalable: Handles high volumes with minimal overhead, reducing cost per transaction

Whether you’re originating loans or trading CLOs, AutoRek delivers tighter control, faster processing, and improved management information (MI) and reporting — all without the need to overhaul your core systems.

Some of the world’s leading firms are already using AutoRek to bring automation into their trading operations.

See our solution in action

If operational complexity is limiting your private credit business, we’d love to show you what’s possible. Book your free AutoRek demonstration today!