Posted: 26/01/2024 | Read time: 5 minutes

From the launch of Consumer Duty to the FCA’s review of the asset management regime, there were many developments UK asset management firms had to grapple with in 2023.

This year, T+1 will go live in the US, with similar developments expected to follow in the UK and Europe. And 2024 looks set to be another year of economic uncertainty, political upheaval and market volatility.

On top of challenging macroeconomic environments, operations departments must continue to service clients and ensure ongoing regulatory compliance, for example with CASS regulations.

So, what are UK asset managers’ top priorities & challenges for the year ahead?

Drawing on results from our industry survey report, we’ve pulled together what will likely be the critical focus for asset managers this year. In this blog, you’ll also learn which departments will see the most significant investment in tech and what firms’ top operational priorities are.

The customer remains a top priority for most firms

Customer experience, acquisition and retention remain central to the UK investment sector. In our report, most respondents (42%) said it was a priority for their firm over 2023 and 2024.

Regulators will be delighted to hear firms are continuing to focus on consumers. Consumer Duty went live in July 2023 and places higher expectations on firms in their interactions with – and protection of – their clients.

Continuing to embed the duty will be a major priority for firms in 2024. The regime’s extension will also include closed products from July 2024.

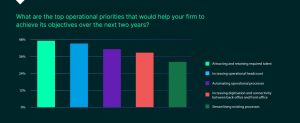

The top operational priorities are employee-related

The top two operational priorities for firms in 2024 are people-related, our report found. Organisations said they plan to focus on attracting and retaining talent and increasing headcount in operational departments.

Recruitment continues to be a significant challenge across financial services, with skilled workers becoming harder to find. So organisations will have to do their bit to ensure the industry is an attractive one to work in – especially for the next generation of employees.

Automation of processes remains key

Over one-third of our respondents stated automating operational processes remains a priority for 2024. If firms are to make the industry and roles appealing to future generations, removing error-prone manual tasks is a key part of that.

Manual operational processes inhibit a firm’s development and present many daily inefficiencies. Firms are acutely aware of the enhancements they can make through the use of automation and see this as a priority.

Economic uncertainty is the biggest challenge

Asset managers said economic uncertainty will be their biggest challenge in 2024. However, the results of our respondents reveal the broad range of challenges facing the industry.

Enhancing systems and processes is a particular challenge. Where priority will always be given to completing business-as-usual tasks, resources rarely allow for time to be spent reviewing processes and identifying and delivering change. Firms need to be clear on their priorities for development and use internal resources as best they can.

Support from external vendors and consultants will remain an important part of driving forward such change in 2024 and beyond.

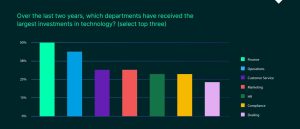

In which departments are firms investing in technology?

With process automation likely to remain a priority in 2024, we also expect the priorities for technology investment to reflect this.

Our respondents indicate that finance, operations and customer service departments will likely receive the most investment. But again, the range reflects the scale of the challenge firms are facing in bringing all areas up-to-date.

The number of firms embracing technology across finance and operations reflects the complexity of these functions, which technology will streamline and simplify. However, these firms should bear in mind the breadth of roles and processes in these areas that require continued investment.

T+1 settlement: UK firms need to prepare for changes

On May 28, the US settlement period will move from two days to just one day. The Association for Financial Markets in Europe (AFME) estimates the move to T+1 will result in an 83% reduction in the post-trade processing time.

UK firms trading on US markets must also comply with the SEC rule change when it comes into effect.

Moreover, as part of the Edinburgh Reforms, the UK has also created an Accelerated Settlement Taskforce to consider the implications of shortening the settlement cycle. It’s widely expected to be a case of “when” the UK will move to T+1, rather than if. So, firms need to prepare for greater demands on operational efficiency.

The taskforce is expected to provide initial feedback this month, which should give an indication of the direction of travel. The final report and recommendations are expected in December 2024.

Check out this blog to learn how T+1 will impact your four key operational processes.

Summary

UK asset managers will need to continue focusing on increasing operational efficiency. Balancing the continued focus on consumers and operational progress is key.

Well-developed operational departments are critical if firms want to service clients and their assets as best they can. So don’t overlook your operational department when considering how to create the best product for consumers.

Regulatory and market change will continue to heavily influence priorities in 2024. With T+1 launching in the US and the UK considering shortening settlement times, firms will have to complete post-trade processing in a lot less time. So speed and operational efficiency will only become more important.

Read the asset management survey report in full here.

We’ve helped the largest firms in the asset management space to reduce operating costs, improve efficiency, achieve CASS compliance and cut time spent on reconciliations by more than 75%. Visit our asset management page to find out more about our solution.