Posted: 02/10/2023 | Read time: 3 minutes

The growth of the digital economy, higher transaction volumes, and more regulations have made reconciliations harder. And it’s clear manual processes are not fit-for-purpose.

Organisations using spreadsheets for reconciliations will experience more breaks, operational inefficiency, and a lack of data control. Manual processes increase the risk of error and inhibit growth.

If you’re looking for an alternative to Excel, this checklist gives you the must-have features of an automated tool. It’s broken down for each stage of the reconciliation process.

By ensuring the solution ticks all the following boxes, you can simplify and streamline processes, cut operational costs, and achieve compliance. This gives you more time for managing exceptions and investigating breaks.

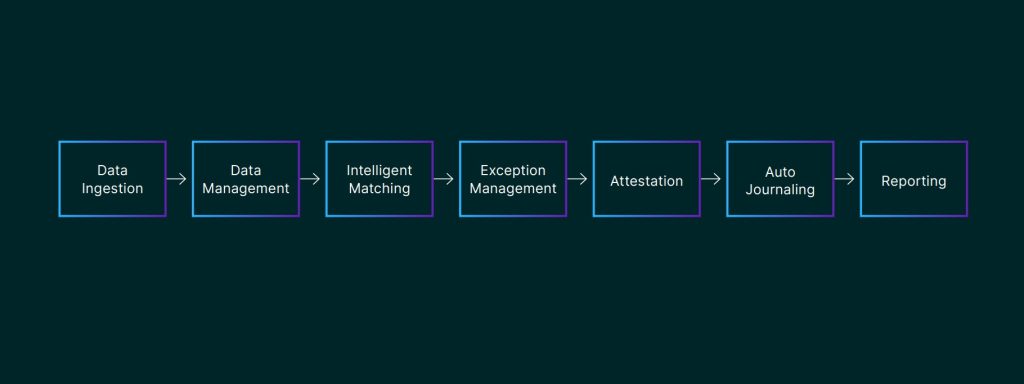

Note: It’s really important the solution automates the reconciliation process from end-to-end. Features at each stage should work together as one unified system.

Click the links to jump to each section:

- Data ingestion

- Data management

- Intelligent matching

- Exception management

- Attestation

- Auto-journalling

- Reporting, dashboarding, and auditing

Data ingestion

- Out-of-the-box support for input formats (e.g. SWIFT, ISO 20022 and CVS)

- OCR support for paper data sources

- Automatic identification of source data formats to simplify the process

- API to programmatically input data

- Canned integrations with ERP, front-office, email, trading, currency management and portfolio management systems

Data management

- Data enrichment and transformation tools to improve raw datasets

- Ability to merge a third data source with raw data files like currency tables

- Ability to consolidate detailed transactions to create summarised transactions

- Can disaggregate or explode bulk entries

- Ability to use one data source for many reconciliations without re-importing

- Reporting labels and fields for downstream classification and exception management

- Full audit trail of the original and transformed files

- Ability to use data management functions without IT support

Intelligent matching

- Intelligent match analysers that recognise fields and suggest optimal results

- Ability to build match rules without IT involvement

- One-to-one, one-to-many and many-to-many match sequencing

- Timing and age-sensitive match rules

- Role segregation for match-rule creation, approval, and execution

- High-speed matching for large volumes

- Ability to schedule match-rule processing

Exception management

- Integral workflow to assign, route and track exception cases

- Ability to surface exceptions into dashboards and work queues to organise and prioritise tasks

- Automatic escalation of breaks that exceed due dates and materiality levels for follow-up

- Consolidated view of all outstanding breaks, user work queues and bottlenecks

Attestation

- A centralised sign-off and attestation hub with full audit trails

- Ability to assign ownership of accounts, transaction types and other criteria

- Clear visibility of ownership across legal entities, business units and locations

- Ability to create and enforce sign-off hierarchies

- Maintains separation of duties

Auto-journalling

- Integral sub-ledger with transactions easily exportable to ERP or general ledger

- Ability to automatically create journals for rounding differences, tolerance write-offs, currency differences and sales taxes

- Support for multi-period, multi-currency and multi-company sub-ledger posting controls

- Journal entry audit trails tied to the reconciliation

Reporting, dashboarding, and auditing

- Full data lineage maintained throughout the process

- A unified database for reporting

- Online dashboards with drill-down and drill-around functions

- Automatic or scheduled report generation

The bottom line

It’s important to look for a solution where all the steps work seamlessly together.

An automated reconciliation solution should have a similar user interface across the entire process. It should not be presented as a series of bolted-together sub-packages.

See AutoRek’s end-to-end solution in action – in 3 minutes.