Posted: 13/04/2023 | Read time: 4 minutes

Reconciliations are becoming increasingly complex.

Transactional volumes are rising as the financial services sector grows and becomes increasingly globalised, frictionless and digital. And, as regulators keep checks on a fast-evolving sector, organisations also face increasingly stringent regulatory requirements.

As the industry changes and companies grow, manual reconciliation tools like Excel will prove time-consuming, inefficient and unreliable. This will ultimately impact the bottom line.

If this sounds familiar and you’re exploring alternative approaches to manual reconciliations, we’ve provided the answers to a few common questions on automation. Click the links below to jump to different sections of the guide:

- What are reconciliations – and why are they important?

- Current challenges of manual reconciliations

- The main benefits of automated reconciliations

- How does automating reconciliations work?

- What types of reconciliations can be automated

- Summary and next steps

What are reconciliations – and why are they important?

The reconciliations process compares internal financial records (e.g. a transaction or balance) against external sources, such as another organisation’s bank statements or ledger records. It ensures the accuracy and consistency of financial accounting.

Reviewing and validating balances and underlying transactions is crucial. Reconciliations support the effective management and reporting of organisational cashflows, mitigate the risk of unexpected overdrafts or credit charges, and prevent fraudulent activity. They also ensure accurate record-keeping, transparency, and are essential for the audit processes.

Current challenges of manual reconciliations

Organisations relying on manual processes to perform reconciliations deal with a higher frequency of breaks and have inefficient operational processes. They rely more on guesswork and lack visibility of the underlying transactional data – damaging auditability.

The financial services sector’s continued expansion, and higher transaction volumes, exacerbate existing challenges. And with the FCA becoming increasingly data-driven, firms need to have full control and oversight of their data to comply with regulations.

Spreadsheets are also detrimental to operational resilience, an area where the FCA recently launched new rules. The regulator requires firms to perform mapping and testing – and make necessary investments – by March 2025 to ensure they can “prevent, adapt, respond to, recover, and learn from operational disruptions.” Manual processes make meeting these requirements more complex.

And because spreadsheets lack scalability, it’s harder for firms to adapt to the requirements of a fast-changing regulatory landscape. Their rigidity also limits company growth as they’re difficult to integrate with wider IT infrastructure.

Organisations relying on manual processes to perform reconciliations deal with a higher frequency of breaks and have inefficient operational processes. They rely more on guesswork and lack visibility of the underlying transactional data – damaging auditability.

The main benefits of automated reconciliations

Automating cuts the time colleagues spend on reconciliations by more than 75%, allowing them to concentrate on value-adding tasks. Not only does this improve company culture and help retain staff, but it reduces operational costs by more than 50%.

Organisations typically achieve a return on their investment within nine months of automating.

Modernising the reconciliations process also helps firms comply with increasingly stringent regulations, reducing the risk of penalties and providing peace of mind when preparing for audits. Firms have total visibility and control over data, with real-time insights and granular reporting.

It’s important to stress that as the industry evolves, automation is not simply a benefit. It’s now a prerequisite for an organisation to flourish in the current economic environment. It’s the key differentiator between firms with healthy profit margins and those without.

By investing in digital transformation, forward-looking firms are more robust and efficient. So they can weather macroeconomic storms and adapt to industry-wide changes.

How does automating reconciliations work?

An automated reconciliation solution will remove the need for spreadsheets, eliminating time-consuming and error-prone manual work. This means skilled colleagues don’t waste time on repetitive tasks. They can instead spend their time on more important jobs, such as investigating the root causes of breaks.

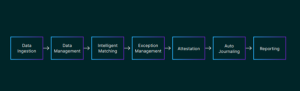

However, not all solutions are created equally. A good automation solution will automate the reconciliation process from end-to-end – from data ingestion to exemption management to reporting. It should not be a series of sub-packages bolted together.

Our reconciliations handbook sets out the must-have features of an automated reconciliations tool. Read it here.

What types of reconciliations can be automated

A good reconciliations tool should be able to reconcile any type of financial data, including:

- Account

- POS/gateway

- Scheme settlement

- Fixed asset or inventory

- Credit card

- Balance sheet

- Transaction

- Bank

- Merchant bank

- Cashflow

- Positions

- Wallet balance

- Interchange fees

- B2B payments

- Supplier statement

Summary and next steps

Firms must automate to remain competitive as the financial services sector becomes increasingly digital and data-driven. By automating reconciliations, organisations ensure their processes are efficient, cost-effective and robust enough to handle growth and industry changes.

Once you have buy-in from colleagues and stakeholders, it’s important to fully understand exactly what you need from a reconciliations tool, and what your goals are. Trying out demos is the best way to then see if a solution is right for your business.

To learn more about the AutoRek automated reconciliation solution request a demonstration with a member of our team to see how it can help your organisation.