Solutions

CASS Compliance

AutoRek saves leading investment firms 80% of time spent on reconciliations for FCA client money and custody asset rules.

Automate reconciliations to gain control and ensure compliance.

Solutions

AutoRek saves leading investment firms 80% of time spent on reconciliations for FCA client money and custody asset rules.

Automate reconciliations to gain control and ensure compliance.

Designed by in-house regulatory experts, our CASS data governance platform is designed to eliminate the manual work required for compliance with the FCA’s CASS rules.

The platform automates all internal and external reconciliations, identifies shortfalls and executes daily client money calculations. The solution provides automated data completeness and integrity checks which enhances governance. It also produces monthly CMAR reports and supports CASS RP processes, giving you more time to focus on what matters most.

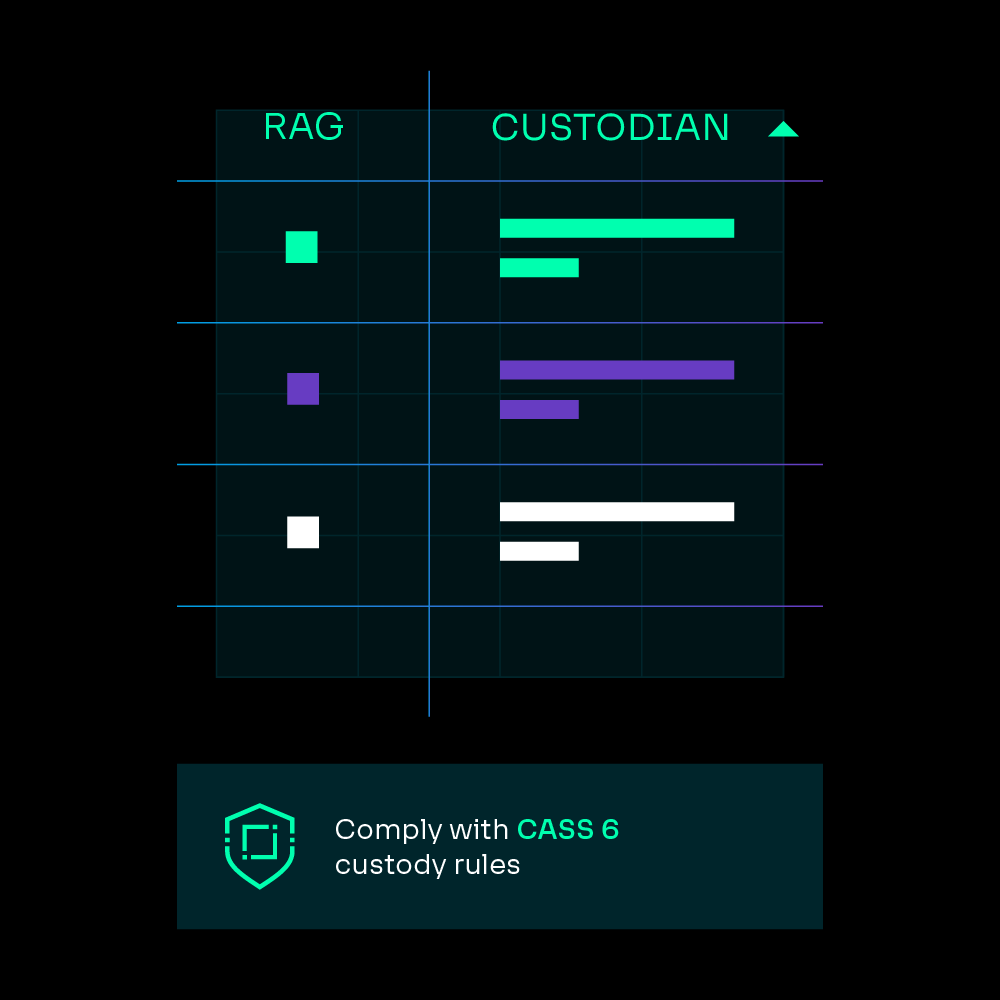

Through automation, our CASS platform is designed to simplify your custody asset reconciliations and guarantee data integrity. AutoRek runs simultaneous reconciliations for multiple legal entities and business units to eliminate manual processes, giving you more time to focus on what matters most.

Automation of CASS 6 reconciliations ensures immediate identification of exception items for further investigation. Where exceptions identify as a shortfall, our platform calculates an up-to-date valuation to be protected by your firm in line with CASS 6.6.54R.

For peace of mind with audits, our CASS platform stores all reconciliations in a single platform to ensure clean audits and efficient regulatory reporting. Your firm can also demonstrate oversight of the process with flexible, built-in workflow functionality.

AutoRek accommodates both client money calculation methods (individual client balance or net-negative balance add back). The solution keeps client money and assets reporting on track, giving you access to extensive real-time MI for transparency.

To facilitate regulatory reporting, daily reconciliation outputs feed into downstream reporting for CMAR and internal reporting. Comprehensive dashboarding functionalities and custom processes provide you with the flexibility to build your solution around your unique business controls.

Demonstrable governance and oversight are key aspects of CASS compliance. Embedded into AutoRek’s CASS platform, our newly developed CASS Governance Toolkit maintains a golden data source of CASS rules and amendments. It allows you to determine the scope of each CASS rule set per legal entity, add bespoke rule interpretations and stay on top of amendments to the rule set.

Within the software, you can introduce CASS risks and controls, assign ownership to key controls and generate immediate point-in-time reports as required. Ongoing oversight can then be demonstrated via regular review and attestation of all rules, risk and control mappings within the tool.

For flexibility, our CASS solution lets you build a master list of mandates, as well as stipulate all details in accordance with CASS 8.3.2 (R). You can also create and assign attestations for a chosen frequency, track and then validate all transactions related to client mandates.

Built-in workflow functionality allows the recording and approval of breaches in your electronic breach log. You can assign a variety of actions to resolve each item, giving you assurance against future breaches and penalties.

AutoRek provides a single, electronic source of breach storage with insight into vital trend data like breaches by month, department or root cause, as well as the monetary value of a breach.